Best SIP Funds Online

For better returns, besides strategic asset allocation, investors often go for tactical asset allocation—shifting allocations slightly, in line with the market conditions. But this works to investors' advantage only if done correctly. For instance, increasing equity allocation when the market valuation is low and reducing it when it is high is likely to generate better portfolio returns.

However, often those who go for tactical shifts in allocation get carried away by the market sentiment, and make the wrong choices. We find investors who were extremely risk-averse during a bear market become risk takers in a bull market. This makes tinkering with one's asset allocation a tricky business.

Instead of reducing their equity exposure now, because of high valuations, investors are shifting more money to equity from other asset classes

Permanent portfolio benefits

The permanent portfolio concept was introduced by investment analyst Harry Browne in his book Fail Safe Investing . This strategy helps cushion the fall in one asset class in a particular market environment by the rise in another in the same environment. For example, equity does well when the economy is in a boom phase, but fares badly during a recession.

The permanent portfolio concept was introduced by investment analyst Harry Browne in his book Fail Safe Investing . This strategy helps cushion the fall in one asset class in a particular market environment by the rise in another in the same environment. For example, equity does well when the economy is in a boom phase, but fares badly during a recession.

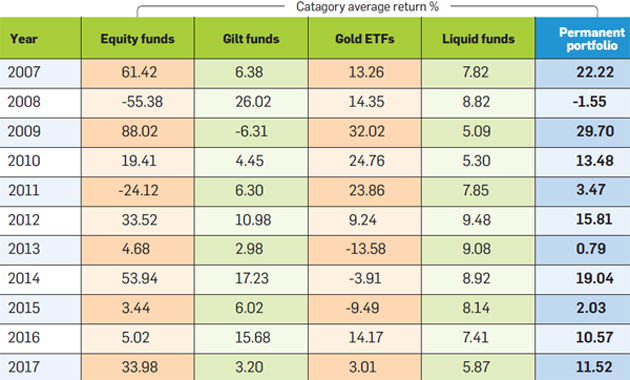

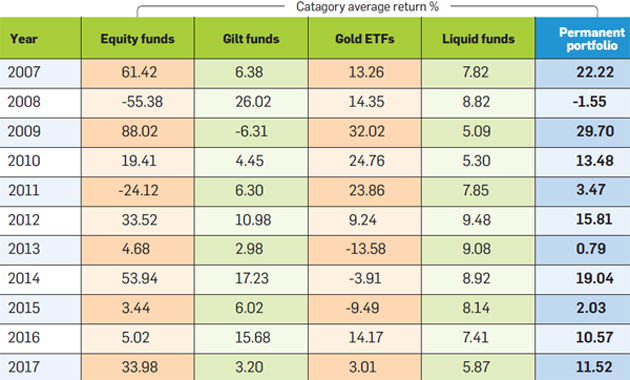

Government bonds, however, fare well during a recession—due the fall in interest rates and the rise in bond prices— and may not do as well during economic boom. To illustrate, while diversified equity funds crashed 55.38% in 2008, long-term gilt funds, which invest in government securities, gained 26.02%.

Since gold is not co-related to the other asset classes, it brings stability to the permanent portfolio and also protects it against sudden global events, which may make other asset classes volatile. Gold also cushions the impact of the rupee depreciation. In 2008, domestic gold generated a return of 14.35%.

So, despite a 55.38% fall in equity, a permanent portfolio in 2008 would have ended up with just a loss of just 1.55% because of the cushion from government bonds and gold. We have used category average returns of diversified equity funds, long-dated gilt funds, gold ETFs and liquid funds as proxies in our study.

Generating moderate returns at very low risk

A permanent portfolio cushions investors against a sharp fall in either of the four asset classes.

A permanent portfolio cushions investors against a sharp fall in either of the four asset classes.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

No comments:

Post a Comment