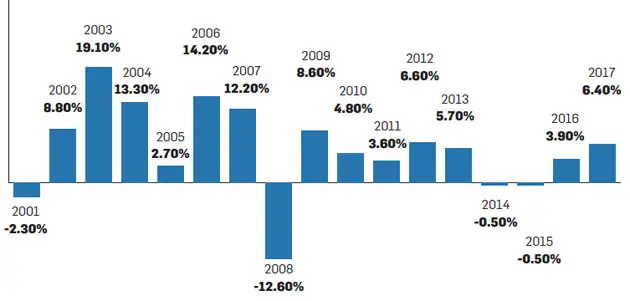

Growth of wealth has slowed

6.4% was the rise in global wealth in the first half of 2017.

Annual percentage change in total global wealth since 2000

9.2% has been the annual growth of wealth in India since 2000. This is faster than the global average of 6%.

Wealth is forecast to grow by 7.5% ANNUALLY to reach $7.1 trillion in 2022

The wealth per Indian is estimated at $5,980 (Rs 3.88 lakh)

Scourge of inequality

But not all Indians have seen their wealth grow.

* 92% of adults have less than $1,000 (Rs 6.5 lakh)

* Only 42 LAKH ADULTS (0.5% of adult population) have a net worth of over $10,000 (Rs 65 lakh)

* 1820 Adults have wealth over $50 million (Rs 325 crore)

* 760 have more than $100 million (Rs 650 crore)

Indians have low debt

Debt per person: 9% of gross assets

India: $376 (Rs 24,400)

US: $1,40,500 (Rs 91.32 lakh)

At 3.5%, the EMI for a loan of Rs 91.32 lakh for 25 years comes to Rs 45,719

In India, at 8.5%, the EMI for a similar loan would work out to Rs 73,537

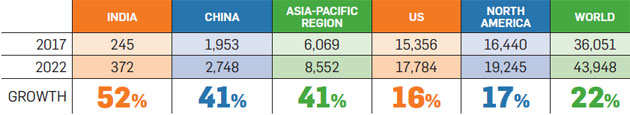

Millionaire club

The number of millionaires in India is estimated to grow very fast in the next five years but this is dwarfed by the growth expected in China and the Asia-Pacific region and is minuscule when compared with developed nations and the world.

Figures in '000s

Report based on Credit Suisse Global Wealth Report 2017

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

No comments:

Post a Comment