Over the past few years, many investors have opted for dividend plans of equity-oriented balanced funds, for regular cash flows, as they rendered tax-free income. Many equity-oriented balanced funds have a history of paying fixed monthly dividend regularly giving investors an informal assurance of regular income. Also, the annualised returns of these plans are generally between 8 percent and 12 percent p.a. The popularity of these schemes may wane as Budget 2018 has announced a 10 percent dividend distribution tax (DDT) to ensure there is parity between dividend and growth schemes, where taxation is concerned.

Dividend distribution tax on equity mutual funds

The main distinction between capital gains tax and DDT is that DDT is paid by the fund house and not by investors, whereas capital gains tax is paid by the investor. Dividends received from all mutual funds remain tax-free in the hands of the investors. However, investors would be impacted as the AMC pays the tax out of the declared dividends and it will reduce the in-hand return to the investor. The Budget has introduced a 10 percent DDT on equity-oriented mutual funds. This 10 percent will be deducted from the dividend announced and then dividend will be paid to the investor. If you include the surcharge and cess, the effective rate of dividend tax is 11.65 percent.

Effect of dividend distribution tax (DDT)

Earlier, in the absence of DDT, an investor would receive the entire amount of dividend declared. Hence, there was no difference between the amount of dividend declared and the amount of dividend actually received by the investors. Now, with the introduction of DDT, the dividend received by the investors will be reduced to the extent of 11.65 percent. The fund house will deduct the tax amount from the dividend declared and the net dividend will be received by the investors.

To understand DDT in a better way, let us consider an actual example:

A balanced fund declared a dividend of Rs. 0.12 per unit with a record date of April 23, 2018. In the absence of DDT, the investor would receive the entire amount of Rs. 0.12 as dividend. Now, with the introduction of DDT, the investor received only Rs. 0.1062 per unit (Rs. 0.0138 deducted as dividend).

Alternative of Dividend Option - Systematic Withdrawal Plan (SWP)

The SWP route now becomes more relevant for fetching regular income from equity funds. Investors will be able to optimize their tax on long-term capital gains accrued on the amount withdrawn under as a SWP (provided it remains below the Rs 1 lakh threshold).

For example:Amount Invested: Rs 25 lakh

Withdrawal: 12% per annum

Amount received per month: Rs 25,000

Amount received per annum: Rs 3 lakh

Exemption on profit per annum: Rs 1 lakh

Considering, the rate of return of 12 percent p.a., an investor would be liable to pay a nominal tax of 2 percent of the amount withdrawn in the first year as short-term capital gains tax. Long-Term Capital Gains tax liability will arise somewhere in the 4th-5th year as at that time the profit amount would be more than Rs 1 lakh. Here, the liability will be approx. 1 percent of the amount withdrawn. The investor will be liable to pay tax only on gains over and above Rs 1 lakh.

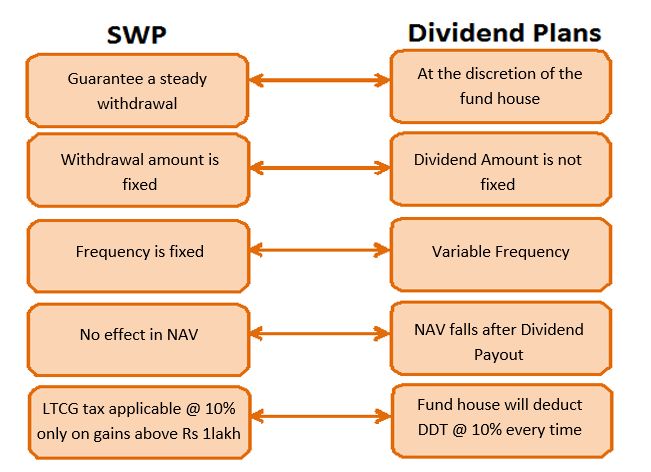

Post LTCG tax and DDT, both the options give almost the same returns. However, leaving the returns criteria aside, SWP is still a better alternative to dividend plans on the following parameters.

SIPs are Best Investments as Stock Market s are move up and down. Volatile is your best friend in making Money and creating enormous Wealth, If you have patience and long term Investing orientation. Invest in Best SIP Mutual Funds and get good returns over a period of time. Know which are the Top SIP Funds to Invest Save Tax Get Rich - Best ELSS Funds

For more information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

No comments:

Post a Comment